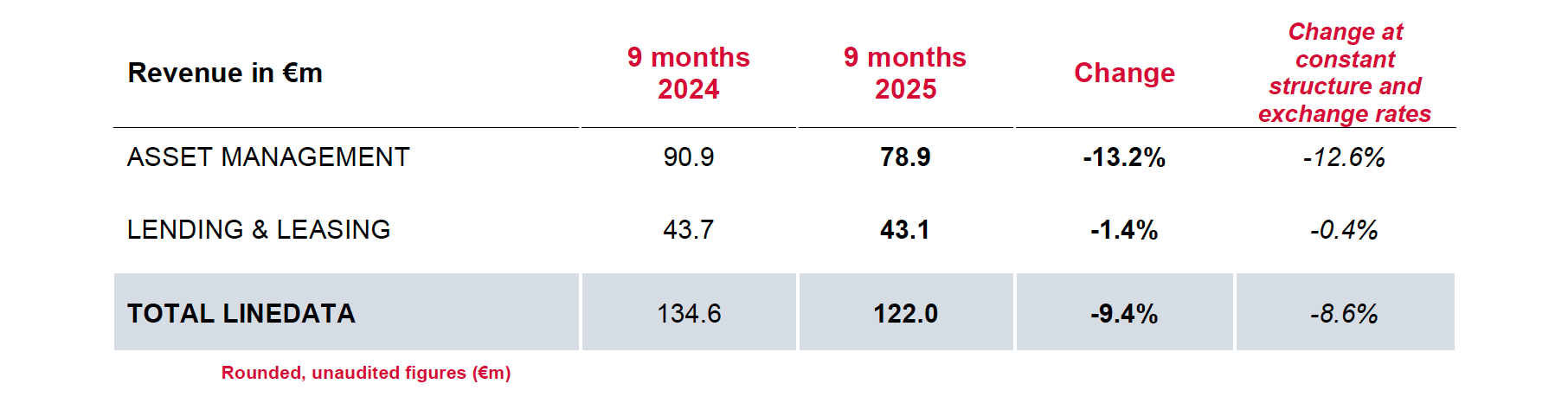

Neuilly-sur-Seine, October 23, 2025 – Linedata (Euronext Paris: LIN), the global solutions and outsourcing services provider to the investment management and credit finance industries, generated revenue of €122.0m in the first nine months of 2025, down 9.4% compared with the same period in 2024. Restated for the effect of the acquisition of NRoad for +€0.8m and exchange rate effects for -€1.8m, revenue declined by 8.6% on an organic basis.

Recurring revenue stood at €96.8m at the end of September 2025, compared with €103.4m at the end of September 2024, and accounted for 79% of total revenue.

After a slight slowdown in business activity in the first half of the year, revenue declined more sharply in the third quarter. This trend worsened due to the impact of the cyberattack in August 2025, which required the operational teams to focus on restoring service and the sales teams to support the clients impacted by the attack, at the expense of prospecting.

Order intake declined in the third-quarter of 2025, totaling €11.7m, compared to €14.9m in the third-quarter of 2024. In the first nine months of the year, bookings amounted to €35.0m, down 38.5%.

Performance by segment:

ASSET MANAGEMENT (Q1: €28.2m, -3.3%; Q2: €28.1m, -7.3%; Q3: €22.6m, -28.0%)

The Software division reported revenue of €55.5m in the first nine months of 2025, down 18.8% compared to the same period in 2024. The decline was more significant internationally, due to the end of AMP migrations and the effects of the cyberattack in the third Quarter 2025.

The Services division reported revenue of €23.4m, up 3.6% on a reported basis and 6.5% at constant exchange rates, driven by strong sales momentum.

LENDING & LEASING (Q1: €15.8m, +7.3%; Q2: €14.5m, -6.4%; Q3: €12.8m, -5.2%)

Lending & Leasing revenue remained nearly stable on an organic basis (-0.4%) during the first nine months of 2025 despite the order intake decrease, at €11.5m

Outlook

Linedata anticipates a 5% to 10% decrease in revenue for the full year of 2025 owing to unfavorable market conditions and the impact of the cyberattack on its business activity in the second half of the year.

Given the substantial share of fixed costs in the Group’s financial model, this decrease in revenue will result in a temporary reduction in performance indicators in 2025. To offset this decline in profitability, Linedata has already implemented operational efficiency measures, the full effects of which will be felt in the 2026 financial year.

Next communication: 2025 revenue, January 27, 2026, after trading.

ABOUT LINEDATA

With over 25 years of experience and 700 clients in 50 countries, Linedata’s 1,300 employees working in 20 offices provide global and human-centric technological solutions and services for the credit and asset management industries that help its clients to develop and operate at the highest level. Based in France, Linedata reported revenue of €183.7m in 2024 and is listed on Euronext Paris Compartment B FR0004156297-LIN - Reuters LDSV.PA - Bloomberg LIN:FP. linedata.com