Tax Management Critical to Advisor Differentiation

November marks the end of the traditional “harvest” season, and for wealth managers, it’s also the time to strategically realize gains and harvest losses before year-end.

Yet in modern wealth management, tax loss harvesting is no longer a once-a-year exercise. It has become a continuous process, powered by data and wealth management technology that enables more precise, year-round tax optimization.

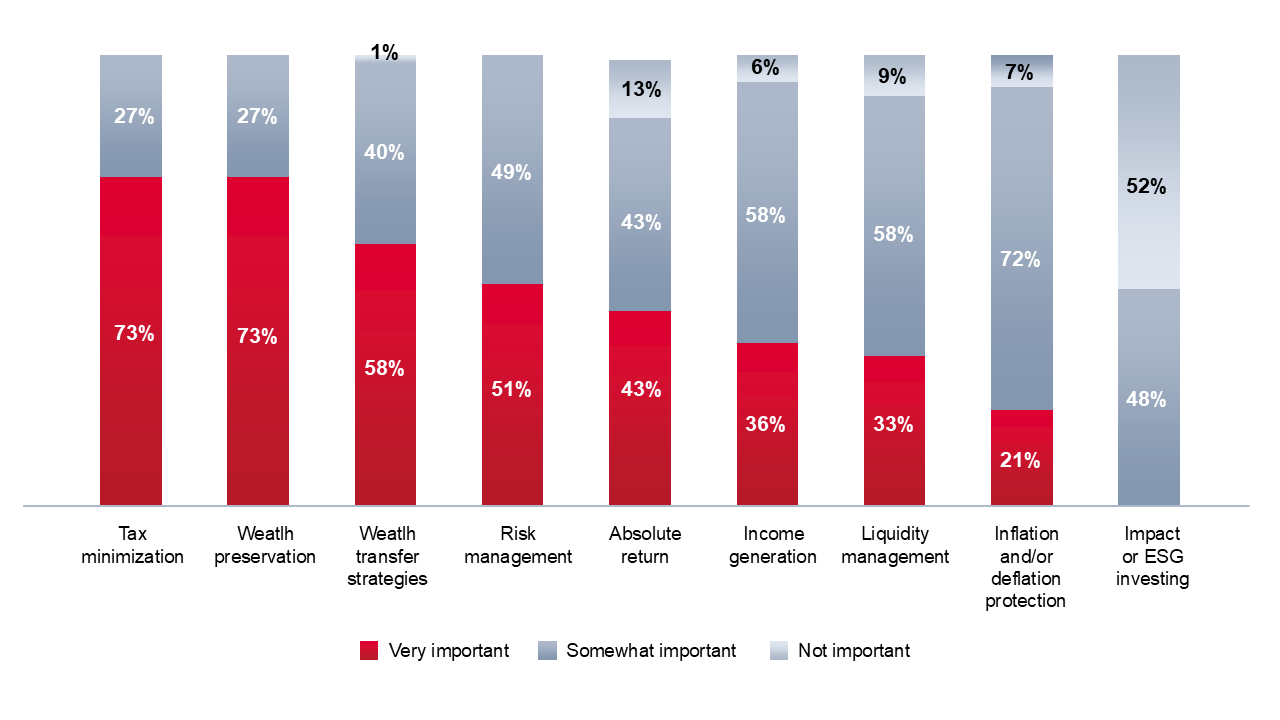

According to Cerulli’s 2025 Wealth Survey, 83% of wealth management firms cite improving tax management capabilities, including transition and loss harvesting, as their top platform development priority, while 73% identify tax minimization as a top client objective (2024 Survey).

Overview

HNW Practices: Most Important Client Objectives

Source: Cerulli Associates 2024 Private Wealth Management Executive Survey | Analyst Note: Participants were asked, "What are the most important investment goals/ objectives among your HNW clients?" This data reflects a firm-level perspective as the survey respondents were heads of wealth management divisions, trust departments, or leaders of independent firms (i.e., RIAs and MFOs).

Collaborative Innovation: Linedata’s Two Decades with Wealth

For over 20 years, Linedata has partnered with leading wealth management firms to create tools and capabilities that address evolving client expectations, regulatory demands, and operational complexity. We understand the challenges wealth managers face in delivering scalable personalization while maintaining compliance and efficiency.

Such partnerships have shaped our approach to product innovation. Rather than developing features in isolation, we co-design solutions with our clients, ensuring that every enhancement directly supports the workflows and goals of modern advisors and their clients. This collaboration has helped firms integrate tax loss harvesting and tax transition management seamlessly into their investment processes.

New Capabilities: Precision Tools for Tax Efficiency

The latest release of our Portfolio Management solution reflects our commitment to tax-aware portfolio management. Developed in close partnership with wealth management clients, the update introduces several capabilities that directly enhance pre-trade decision-making, compliance, and tax efficiency.

Key features include:

- Advanced alerting for pre-trade compliance and wash sales: Advisors receive real-time notifications to prevent wash sale violations and align trades with firm-level strategies.

- Automated taxable status verification: Each account’s taxable status is confirmed automatically, ensuring accurate trade execution and improved oversight.

- Integrated tax-awareness in portfolio modelling: Tax implications are embedded into rebalancing and workflows, allowing advisors to tailor strategies to each client’s unique tax posture.

Together, these enhancements strengthen operational precision and improve client outcomes—hallmarks of effective wealth management technology.

A Competitive Advantage in Every Season

As consolidation, regulation, and client expectations reshape the wealth management landscape, the ability to demonstrate proactive tax-aware portfolio management has become a competitive differentiator. Firms that can harvest losses efficiently and model after-tax outcomes are positioned to deliver measurable value and deepen client trust.

Linedata’s wealth management solutions are designed to empower advisors and firms to do exactly that—combining robust technology, operational expertise, and deep industry insight. This season, as firms focus on “harvest time,” Linedata continues to invest in solutions that help wealth managers cultivate performance, compliance, and client satisfaction all year long.

About the author, Greg Grimmett

Greg Grimmett is a Global Product Manager for Linedata’s front office solutions. He has held multiple client-facing roles in addition to being a product expert during his 20 years at Linedata. Earlier, Greg was a Linedata client himself at a major bank/wealth manager.

Insights

Wealth management technology faces challenges from a new generation of advisors and investors. How can systems and...