Neuilly-sur-Seine, 14 February 2022 – Linedata (LIN:FP), a global software and outsourcing services provider for the asset management, insurance and credit finance industries, announces significant growth in 2021 full-year results.

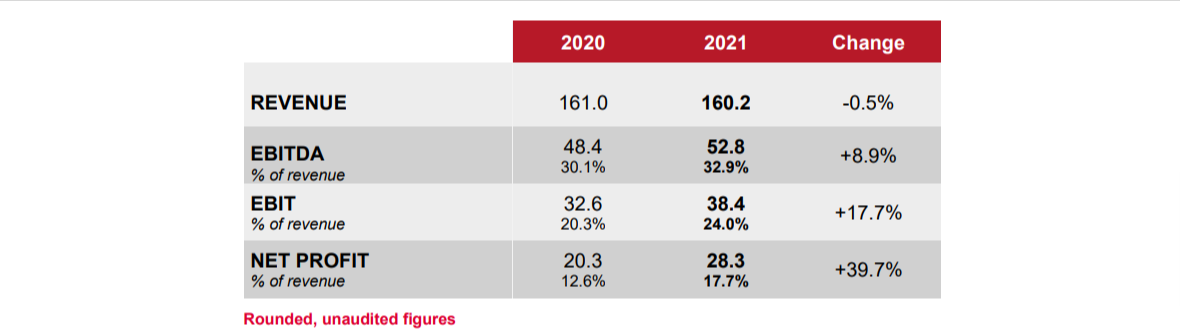

2021 Group revenue was down 0.5% in reported terms, but up 0.5% in organic terms to €160.2m.

2021 performances benefited from the full effect of cost management efforts implemented in 2020 as the health crisis set in. These were driven especially by more efficient operating processes, applied to all divisions (R&D, delivery and implementations, support).

Asset Management

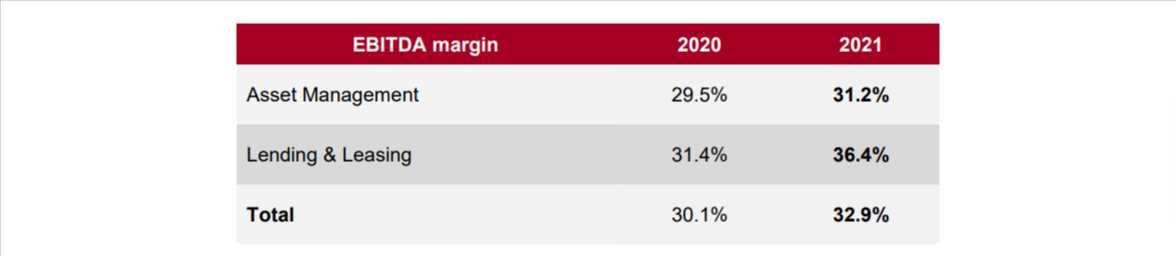

The Asset Management segment benefited from momentum in the Services division as well as revenue from migrations of existing clients to the new Linedata AMP platform. Revenue from fund administrators was down slightly. EBITDA totalled €33.7m, producing a margin of 31.2%.

Lending & Leasing

The Lending & Leasing segment grew thanks mainly to the good performance of the Linedata Ekip360 offering, which in 2021 confirmed its status as a benchmark solution for financial institutions specialised in leasing, consumer credit and vehicle finance. EBITDA was €19.1m, or 36.4% of revenue.

Results analysis

Group EBITDA rose 8.9% to €52.8m. This increase reflected measures to improve productivity taken in 2020. It also benefited from a favourable comparison base for the previous year during which €1m of restructuring costs were recognised. This record high level of EBITDA continued to reflect a temporary decline in expenses related to the pandemic, such as a freeze on travel and event cancellations.

EBIT stood at €38.4m, rising by a robust 17.7% relative to 2020. This reflected a €1.6m decline in provisions related to the end of depreciation of intangible assets arising from the acquisitions of Gravitas and Capitalstream.

Financial income was €0.2m compared to - €5.3m for the previous year. The difference stemmed primarily from forex gains of €2.6m in 2021 compared to a forex loss of €2.6m in 2020, as well as a €0.6m reduction in the cost of financial debt related to the early redemption of €35m in bond debt and the renegotiation of a syndicated bank loan with better terms.

The tax expense for 2021 came to €10.3m up €3.2m relative to 2020. This increased stemmed from the increase in the taxable base related to higher earnings, as well as a temporary base effect with the adoption in 2020 of the IP box facility, which enabled the Group to book two years of tax savings (2019 and 2020) in one financial year, including a €1.2m tax reduction for 2019. Net profit therefore amounted to €28.3m, up 39.7%, reflecting a net margin of 17.7%.

Earnings per share (EPS) totalled €4.42 in 2021 vs. €3.09 in 2020.

Balance sheet analysis

Shareholders’ equity increased by €24.3m to €145.8m, primarily due to the impact of net earnings for the year. Net debt* was down significantly at €43.2m (vs. €67.1m) reflecting the strength of Linedata’s business model which produces strong cash generation in all market segments. Net debt represented 0.9x 2021 EBITDA excluding the impact of IFRS 16.

Dividend

A dividend of €1.60 is to be proposed at the next Annual General Meeting.

Outlook

Strengthened by the successful migrations of the existing clients to the new software platforms, Linedata is set to improve its commercial development in 2022 with new, prospective clients with a software and services offering that is well aligned with the expectations of Asset Management and Lending & Leasing companies.

Next communication: Q1 2022 revenue on 21 April 2022 after trading. *excluding IFRS 16 lease liabilities but including the property lease portfolio

ABOUT LINEDATA

With 20 years’ experience and 700+ clients in 50 countries, Linedata’s 1100 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries that help its clients to evolve and to operate at the highest levels. Headquartered in France, Linedata achieved revenues of EUR 160.2 million in 2021 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP. linedata.com