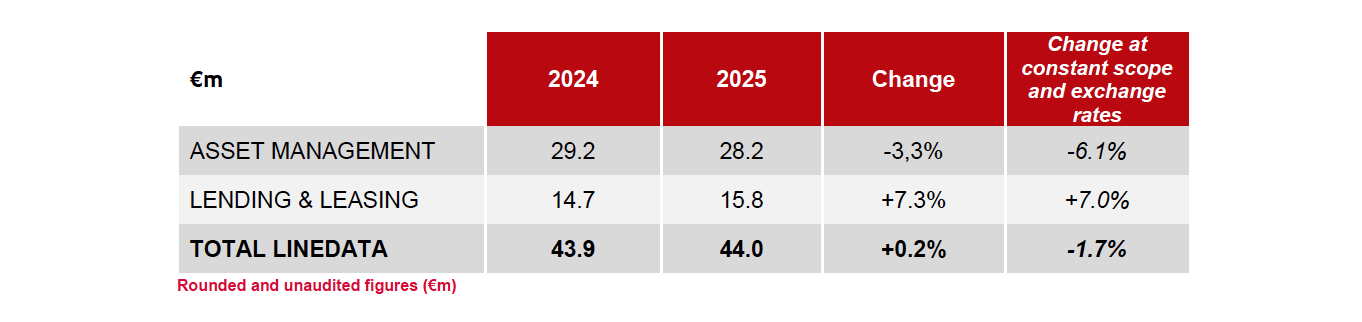

Neuilly-sur-Seine, April 24, 2025 – Linedata (LIN:FP), the global solutions and outsourcing services provider to the investment management and credit finance industries, generated revenue of €44.0m in first-quarter 2025, stable compared with first-quarter 2024 but with contrasted performances between the Asset Management segment, down 3.3%, and the Lending & Leasing segment, up 7.3%. Restated for a favorable currency effect (€0.7m) and scope effect (€0.1m), like-for-like revenue was down 1.7% compared with Q1 2024.

Recurring revenue totaled €35.2m, accounting for 80% of total revenue, and was stable compared to last year

Amid a deteriorated economic environment, sales activity contracted, with order intake of €14.7m, down 29.1% compared with Q1 2024.

Performance by segment:

ASSET MANAGEMENT (Q1: €28.2m, -3.3%)

The Asset Management segment was down slightly in Q1 2025, by 3.3%, with both divisions contributing to the decrease. Order intake came out at €11.1m, close to the Q1 2024 performance (-€0.4m).

The Software division posted revenue of €20.2m, down 3.8% on a reported basis and down 6.5% like-for-like. The business benefited from the resilience of Funds Services applications but was adversely affected by a slight downturn in revenue with hedge fund customers.

Revenue for the Services division amounted to €8.0m, for a more limited decrease of 2.0% on a reported basis and 5.1% on an organic basis. Co-sourcing revenue continued to trend positively, up 2.9%, with the decline resulting primarily from the consulting business, which is more volatile.

LENDING & LEASING (Q1: €15.8m, +7.3%)

Revenue for the Lending & Leasing segment grew sharply in Q1 2025, totaling €15.8m, for a 7.3% increase on a reported basis (+7.0% like-for-like). Growth was driven by the Group’s two flagship platforms, Linedata Ekip360 and Linedata Capitalstream.

With no major contracts signed since the start of the financial year, order intake in Q1 2025 was down 61.5% to €3.6m.

Outlook

The recent acquisition of Nroad will contribute to Linedata's innovation strategy, particularly in the area of Artificial Intelligence.

Next communication: Half year revenue 2025, on July 24, 2025 after trading.

ABOUT LINEDATA

With 26 years of experience and 700+ clients in 50 countries, Linedata’s 1,300 employees in 20 offices provide global humanized technology solutions and services for the asset management and credit industries, helping its clients evolve and operate at the highest levels. Headquartered in France, Linedata achieved revenues of EUR 183.7 million in 2024 and is listed on Euronext Paris compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg LIN:FP www.linedata.com